As has been the case for the last ten years or so, the U.S. economy continues to grow at a rate that has failed to meet expectations. The recently released numbers from the Commerce Department show GDP growth is at only 2.3 percent, significantly below the expected 3 percent being looked for.

It has been a full decade since the last time the GDP has grown above a 3 percent rate, making it the weakest recovery in about 70 years. Economic growth hasn't surpassed the 3 percent mark since 2005, according to the Commerce Department.

more on U.S. economy

Everything on commodities brokers, futures trading, commodities trading, gold, silver, futures brokers, oil futures, business news, markets and commodities options ...

Showing posts with label US Economy. Show all posts

Showing posts with label US Economy. Show all posts

Tuesday, August 4, 2015

U.S. Economy Failing to Meet Expectations

Labels:

Commerce Department,

GDP,

US Economy

Tuesday, May 7, 2013

Silver's Performance in a Weak Economy

Silver in general is standing at a very interesting position, as it's poised to break out in the short term, while at the same time a weakening economy will play havoc with the precious metal over time.

We'll look at some myths surrounding silver in this article, as well as some of the realities inherent in silver as an investment option.

See how silver will perform during economic weakness.

We'll look at some myths surrounding silver in this article, as well as some of the realities inherent in silver as an investment option.

See how silver will perform during economic weakness.

Labels:

Economic Crisis,

Economy,

Investing Silver,

Silver Prices,

US Economy

The American Economy Is Recovering, It Really, Really Is - Wink Wink

It's incredible to me to see the financial media portray the American economy as one that is in a sustainable recovery. Data and facts are selectively reported and manipulated to present the strongest economy possible without media being considered nonsensical.

I don't mean by that there isn't any reporting of the negative economic facts, as the mainstream media wouldn't even be taken half seriously if they weren't. Yet in the majority of cases there are omissions concerning the analysis of the data. For example, with the recent unemployment numbers, where what was highlighted was the drop in the number of unemployed, but not why that was a disaster rather than a positive outcome.

The over emphasis of one element of the economic data, while minimizing another, is the game being played in the financial media now, one all investors must recognize in order to protect their capital.

Politics, Media and the Economy

What must be acknowledged and understood is the media in general have migrated their political way of reporting into the financial realm. That means because there are certain things networks, reporters and writers believe, they allow that to dictate how they present the news and data, and how it is written, to bolster their own political outlook and beliefs.

I don't care, but I'll get a few of you riled up here: this is especially true with liberals. The point isn't politics though in this article, and whether you're a liberal or not, it must be understood that politics has mixed in thoroughly with the economic and financial, and it's difficult to extricate them when looking for actionable data and news from media outlets.

For example, if you have liberal political leanings, it isn't the purpose of this article to point to the political side of it, but to help you to understand when media you would agree with when talking politics transfer their focus to economics and business, you have to be careful not to drink in the reporting in a way you would when engaging with a political campaign. Most people recognize all the hoopla and exaggerations of politicians and their aides, but it's not as identifiable when the writing or reporting migrates to business. This is especially true concerning the condition of the American and global economy, which reflects directly on a President and the party in power.

No matter what your political persuasion, be careful of financial reporting, especially in relationship to the economy. You also have to careful in regard to certain sectors that are political magnets, such as energy.

Agreeing with the world view of a writer, reporter or news outlet is completely different than looking objectively at the hard data.

Quick Example

Just to give you an idea how financial data can be reported as better than expected, here's how the recent data concerning the devastating drop in durable good orders was presented.

The decline in orders is the latest in a string of reports that suggest the manufacturing sector cooled off a bit toward the end of the first quarter - along with the broader economy.

As is often the case, a large swing in monthly orders for large and expensive commercial aircraft exaggerated the headline number on durable goods.

Notice how the huge 5.7 percent drop in durable goods was presented as this: "the manufacturing sector cooled off a bit." Below that the drop in monthly orders in commercial aircraft "exaggerates" the numbers associated with durable goods. This is irresponsible reporting at best, yet most people don't even see the subtle way the data is skewed to look far less ominous than it is.

Throughout the article most data are minimized, until finally near the end the revelation durable goods orders are revealed to be significantly downwardly revised for February, being lowered for a gain of 5.6 percent to a lower gain of 4.3 percent. That is a big difference, yet it's reported with no commentary and a noticeably absent shrug.

Unemployment Numbers and the Economy

Now let's look at the latest unemployment numbers. The U.S. Bureau of Labor Statistics reported the economy added 165,000 jobs in the prior month, while the unemployment rate fall 0.1 percent to 7.5 percent. That means the U.S. economy is chugging along nicely right? Wrong.

• barely keeps up with population;

• features mostly temp workers;

• leaves out prime-age males and all young workers;

• and keeps labor participation rate at a low level from 1979.

The temp workers are the most interesting to me. [It's a direct result of Obamacare,] whereby companies are protecting themselves by starting to hire temporary or part-time workers.

Consequently, a number of workers then go out and get a second job, giving the appearance there is more participation in the workplace than there really is, as well as more hiring being done than is the reality, as far as new workers entering the work force goes.

All of this must be properly identified and assessed by investors looking for data that give them as realistic as a look at what is really happening.

When all is said and done concerning jobs numbers, they are still all estimates, even when there are revisions to original data.

Besides all that, a big portion of the lower unemployment numbers come from those simply leaving the job market altogether; they're no longer looking for a job. At this point in time lower unemployment data are an irrelevant metric for investors and the health of the economy. That will remain that way until meaningful, full-time jobs are created.

Durable Goods Orders

The importance of durable goods data are they reflect how far beyond core staples Americans are acquiring. Lower durable goods orders mean they consumers are spending primarily based upon needs and not wants. It's not a sign of economic growth by any stretch of the imagination.

It also implies the lack of willingness of people to commit to long-term purchases of more expensive items. These include furniture, appliances, and heavy machinery, among many other products.

Two segments in durable goods orders that improved were orders for communications equipment and computers. Autos and auto parts saw a slight increase in orders, but that was only 0.2 percent, the lowest orders so far in 2013.

While not the pervue of this article, the boost in tech-related orders confirms my outlook for the big tech companies, which is they are about to soar.

Overall though, the drop in durable goods orders points to a cautious outlook, one that doesn't strengthen the idea we're in any type of real and sustainable recovery.

Orders for durable goods fell 5.7 percent.

Company Earnings

Another key factor in assessing the real condition of the American economy is what the earnings results really represent for publicly traded companies. While earnings are being touted in many cases during this earnings season, the reality is the majority of those earnings are from cutting costs rather than growth.

Companies are cutting to maintain an appearance of health, while they wait and hope for the economy to experience real growth.

If the economy doesn't pick up this will be exposed, as there isn't that much more companies can do to lower costs, as many have cut as close to the bone as they can.

Other than the occasional exception, the earnings of companies aren't something that can be relied upon, other than pointing to management doing what it can in a very weak economy to generate earnings.

The Federal Reserve has the Pedal to the Metal

If the economy were really doing that well, there would of course be no need for the Federal Reserve to continue to create money out of thin air. The fact that it has no intention of stopping stimulus measures points to the reality that the economy can't stand on its own, and when you look at the results of the stimulus, can't grow either.

What's disconcerting there is the Fed and Ben Bernanke continue to do the same thing with no positive results. What they need to do is take a step back and look deeper into the causes of no real growth after the creation of trillions of dollars.

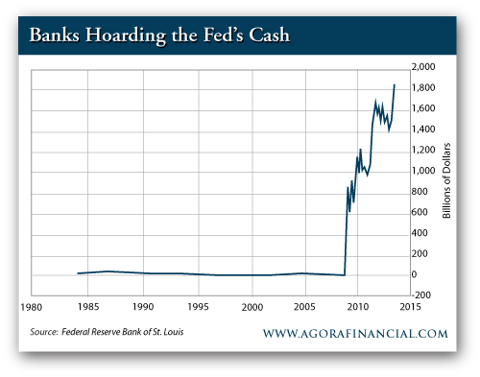

One of the more obvious problems is banks aren't spending the created money, they're hoarding it while also using it to shore up their balance sheets. It's not reaching consumers or others wanting access to the capital.

All the money provides cover and the illusion of recovery, but if trillions do little or nothing to help, how can the creation of more money bring about different results?

Just picture banks and the government digging a pair of holes together using shovels. They both dig a hole, and then each throws the dirt they shoveled into the hole the other dug. That's the basic story of banks and the Fed at this time. It's simply done over and over again with the end result always the same. Maybe that's those shovel-ready jobs the administration has been talking about.

Money Velocity

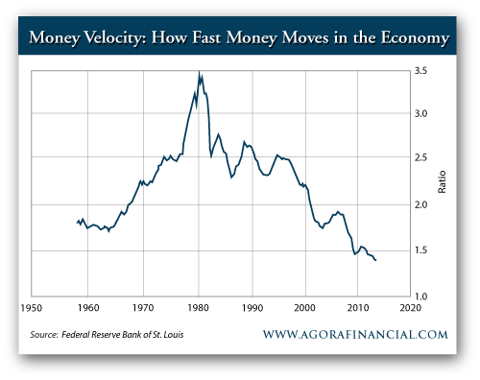

One metric few investors consider or know about is that of money velocity. What this represents is the pace at which money is spent. This is one of the numerous things Keynesian money creation has no control over. Only those borrowing and spending have power to determine this, and it's totally related to the choices of those with capital at their disposal.

As inflation has dropped over the last 3 decades, so also has the velocity as which people spend money. This is a major factor in real economic growth, one that stimulus supporters don't want the average person to know about or consider. Those of us wanting to understand the health of the economy need to know this.

Lower Interest Rates

From all of this you may think I'm about to go into bearish mode for equities, but I'm not. The reason is there is another key element in the economic and investing picture, and that is low interest rates.

What that has done has pressured many investors out of what would have been considered safe cash investments, and moved them into equities. That's why there has been such a strong move in blue chip stocks with a good dividend record over the last year or so. Unless money is allowed to sit and do nothing in an extremely low-interest account or investment, it must be put to use somewhere. Over the last 12 months that has been blue chip stocks.

Those include Proctor & Gamble (PG), Kraft Foods Inc. (KRFT), 3M Company (MMM) and Merck & Co. (MRK), among many others.

Performances of the stocks over the last year are shown below.

3M

Kraft

Merck

Proctor & Gamble

The reason for showing these is to confirm people have been investing in blue chip stocks over the last year or so in lieu of placing money in banks, CDs, money market funds, and other non-producing financial instruments.

Obviously not everyone is doing this, but a large portion are, which has been the major impetus behind the climb in blue chips during a weak economy. It appears that blue chip period is starting to wane, with a new focus on big tech stocks emerging as the investment of choice.

All of this is to say it's the consequence of low interest rates, which have forced a lot of money into equities that wouldn't have otherwise been there.

During the next couple of years we'll probably see money travel about to different sectors of the market until those particular sectors exhaust themselves. At that time capital will find a new home. Also during this time it looks like each step will include a little more risk tolerance, which is why the recent upward tick in large tech stocks appears to be the next place investors will park their money.

Some big tech stocks moving up since the middle of April include Apple (AAPL), salesforce.com, inc (CRM), Microsoft (MSFT) and IBM (IBM). I would look for low forward price-to-earnings ratios and good entry points. Since it looks like this sector is about to take off, entry points look good right now.

No matter how much money the Federal Reserve or other central banks print, it's only if the money is spent which will determine the economic effect. That means the Fed really has limited power, and only the low interest rates have resulted in investors pouring money into equities, creating the illusion of prosperity and confidence.

The truth is consumer confidence is anemic, and that is evidenced by the hard data of the drop in durable good orders, which points to the fact consumers are also hoarding their money, using it for necessities of life rather than higher-priced items.

Conclusion

This article wasn't meant to be an exhaustive look at the American economy, but enough to show there are forces at work to make it look stronger than it really is. That includes media reports, skewed government data, a lack of understanding of effects of the Federal Reserve, and how low interest rates are driving the investment of capital.

What kind of recovery doesn't create jobs, has one of the slowest rates of growth in modern history, includes falling incomes, and includes little small business creation?

The reason for all of this is the Federal Reserve refused to allow the economy to take its natural course and cleanse itself out, which would have resulted in a more healthy economy going forward. Instead Bernanke and others got a messianic complex and decided we just shouldn't be allowed to experience the normal process of some temporary economic pain. That has produced where we are today, and the practices continue on. It's not going to end well when it all collapses.

What will happen in the short term (next couple of years) is what's relevant to investors. Money always finds a place to work, and the low interest rate environment, which will continue on for some time, is pushing people to put their money in investment vehicles they normally wouldn't have.

We need to watch the trends as they unfold, with the blue chip stock trend starting to wind down and the large tech stock trend starting to unfold. Once the tech stock trend slows down, money will look for another place to land. That probably won't be for another year or so, assuming the tech trend lasts as long as the blue chip trend did.

That's not to say some blue chips won't continue to climb, as some appear to be. But a number of them have reversed direction over the last couple of weeks right at the time the large tech stocks have started to rise. That suggest the money has been taken out of a lot of blue chips and reallocated to big tech. The trend has started, and I don't think this current cycle of investing is going to stop for some time. Money is simply going to migrate from sector to sector as risk tolerance increases. I think that gives a hint as to where money will go after the tech trend is over.

If this is the scenario, why be concerned about the American economy then? The reason is it is still being propped up by smoke and mirrors, and has very little foundational strength behind it. We must understand that even as we continue to stay in the market.

It also means the scenario can change very quickly when a central bank is printing money like it is today. We are in uncharted territory, and when most data point to fearful consumers and weak job numbers, we need to admit the economy is like a big house we built using a deck of cards. An unexpected wind could easily blow it all down.

When reading news stories and reports, we have to, more than ever, read and digest the terminology used and hard data reported. The hard data needs to be what we pay attention to, not the words used to manipulate that data in our minds. We shouldn't look for false comforters, but those presenting the best facts available so we can make informed decisions, whether the data are scary, negative or positive. In times like these we need reality more than ever.

The American economy is extremely fragile, and still years away from any meaningful, sustainable recovery. That must be part of our mindset when we make any investment decision during this season of time.

Labels:

3M,

Apple,

Economy,

IBM,

Kraft,

Microsoft,

Proctor Gamble,

US Economy

Saturday, February 2, 2013

Morningstar Analyst: Dow 14,000 Here to Stay

It'll be interesting to see if Robert Johnson, director of economic analysis for Morningstar, will regret his assertion that it wouldn't be surprising if the Dow were to linger in the 13,500 to 14,500 range for some time.

The few times the Dow has surpassed 14,000 in the past, it wasn't long afterwards that it came plummeting down in a most aggressive manner. Johnson says he doesn't think that will happen this time around based upon his belief the economy is stronger than in the past when it hit those numbers.

He cited a stronger banking system and housing market as the main indicators for his outlook.

Johnson also sees stocks as being valued in line with the reality of the performance of the companies rather than being overvalued.

The major problem is most of the outperformance of publicly traded companies in the earnings season has come from cost cutting, even though revenue is up so far with the companies listed in the S&P 500 by 1.2 percent.

It's hard to understand why the Dow is approaching record territory with the very weak global and U.S. economy. There is no doubt the Dow will come crashing down, but it may have more legs on it than bears are thinking at this time.

Even so, this performance is living on borrowed time, as Spain remains a disaster in Europe, the U.S. economy contracted last quarter, the jobless rate for the week ending January 26 jumped by 38,000, and when including people claiming benefits from all programs at the end of the week on January 12, it soared to 5,914,983, a boost of 255,501 from the prior week.

How that is interpreted as something that has legs and isn't a major challenge has to be related to wishful thinking rather than facing reality.

The few times the Dow has surpassed 14,000 in the past, it wasn't long afterwards that it came plummeting down in a most aggressive manner. Johnson says he doesn't think that will happen this time around based upon his belief the economy is stronger than in the past when it hit those numbers.

He cited a stronger banking system and housing market as the main indicators for his outlook.

Johnson also sees stocks as being valued in line with the reality of the performance of the companies rather than being overvalued.

The major problem is most of the outperformance of publicly traded companies in the earnings season has come from cost cutting, even though revenue is up so far with the companies listed in the S&P 500 by 1.2 percent.

It's hard to understand why the Dow is approaching record territory with the very weak global and U.S. economy. There is no doubt the Dow will come crashing down, but it may have more legs on it than bears are thinking at this time.

Even so, this performance is living on borrowed time, as Spain remains a disaster in Europe, the U.S. economy contracted last quarter, the jobless rate for the week ending January 26 jumped by 38,000, and when including people claiming benefits from all programs at the end of the week on January 12, it soared to 5,914,983, a boost of 255,501 from the prior week.

How that is interpreted as something that has legs and isn't a major challenge has to be related to wishful thinking rather than facing reality.

Thursday, July 12, 2012

Warren Buffett Finally Admits US Economy Weak

After months of data showing the U.S. economy is stagnant, Warren Buffett finally has admitted the economy of the country is "more or less flat," during an interview on CNBC.

Buffett has been a cheerleader for Obama and his failed economic policies, not willing to say it was in major trouble in an apparent nod towards not wanting to make Obama look bad in a reelection year.

Trying to salvage something positive out of the acknowledgement for Obama and the American economy, Buffett added there has been a boost in the residential housing sector, although saying it "doesn't amount to a whole lot yet, but it's getting better." That's basically a meaningless and irrelevant comment and observation.

Buffett has been trying to spin the idea that economic growth in the U.S. would pick up once the residential housing market began to recover. That hasn't happened at all.

Talking on the euro zone, Buffett noted it is falling apart economically very quickly, citing the last six weeks in particular. Taking the longer outlook, he said he believes the region will work out its issues, but it could take up to a decade before it happens.

Buffett also said he doesn't believe the euro zone will be what its creators had originally envisioned in the next ten years, and isn't certain the euro will survive as a currency.

Going back to his cheerleader role, Buffett asserted that in spite of the weaker American economy, it's doing better than the other major economies around the world. I guess he doesn't follow the growth rate of China, even when it's slightly slowing down in growth. It's still growing at a far more rapid pace than the American economy.

Finally, Buffet implied he has no idea which direction the economy is going, and said "to some extent" is awaiting until things become clearer.

Buffett has been a cheerleader for Obama and his failed economic policies, not willing to say it was in major trouble in an apparent nod towards not wanting to make Obama look bad in a reelection year.

Trying to salvage something positive out of the acknowledgement for Obama and the American economy, Buffett added there has been a boost in the residential housing sector, although saying it "doesn't amount to a whole lot yet, but it's getting better." That's basically a meaningless and irrelevant comment and observation.

Buffett has been trying to spin the idea that economic growth in the U.S. would pick up once the residential housing market began to recover. That hasn't happened at all.

Talking on the euro zone, Buffett noted it is falling apart economically very quickly, citing the last six weeks in particular. Taking the longer outlook, he said he believes the region will work out its issues, but it could take up to a decade before it happens.

Buffett also said he doesn't believe the euro zone will be what its creators had originally envisioned in the next ten years, and isn't certain the euro will survive as a currency.

Going back to his cheerleader role, Buffett asserted that in spite of the weaker American economy, it's doing better than the other major economies around the world. I guess he doesn't follow the growth rate of China, even when it's slightly slowing down in growth. It's still growing at a far more rapid pace than the American economy.

Finally, Buffet implied he has no idea which direction the economy is going, and said "to some extent" is awaiting until things become clearer.

Labels:

Barack Obama Economy,

US Economy,

Warren Buffett

Friday, September 24, 2010

Warren Buffett Losing it? Attacks Tea Party over "Anger"

When you think of Warren Buffett, the first thought that usually comes to mind is one of the greatest investors of all time, with the trained ability to be able to consume economic data in a way that he can make extremely accurate projections of how a company will perform over the long term; something a small handful of people have the skill to do. And Buffett is among the elite in history.

Buffett's problem is in his later years he has increasingly emerged as a big government backer, and as committed to Keynesianism as anyone around, and uses his popularity to justify outrageous spending, especially by his man Obama.

It makes me wonder if the years he spend building his legacy will crumble from these last years of his life, as America rises up against the things he's supporting and backing.

Recently he made the incredible statement that Americans should quit being angry at the government, and get over it. That was a direct attack on the tea party movement, no matter how it is spun later.

After all, while the majority of Americans are already fed up with the Obama administration and their destructive policies, the tea party is the outlet of that frustration, and for Buffett to outright attack them and their anger, goes beyond his pay grade, as some politician said not that long ago.

Buffett said, "...it is not helpful to have people as unhappy as they are about what’s going on in Washington.”

As Buffett has aged, he doesn't seem as coherent as he was in his youth, and he can make what appears to be contradictory statements about the same issue.

For example, he says we shouldn't be angry, but then says things like this: “The truth is we’re running a federal deficit that’s 9 percent of gross domestic product. That’s stimulative as all get out. It’s more stimulative than any policy we’ve followed since World War II.”

He also recently stated we're still in a recession, something we've continue to say here at Commodity Surge.

So the government is stimulating beyond imagination, stealing from the future of our children and grandchildren, saying they're ready to do it again via the Federal Reserve, but we need to just relax and let the government do what it wants no matter how destructive it is.

Respected or not, Buffett is just another Obama backer who drank the Kool Aid and in a state of being mesmerized, throws away a lot of what he would have opposed in the past.

In reality, it seems Buffett has been afraid of the government because he understands the monopoly it holds, and how it extends beyond its mandate.

That's why if you ever read his Berkshire Hathaway (NYSE:BRK-A) quarterly reports, you'll see he never attacks the outrageous taxes corporations and individuals have to endure from the government, as he knows it'll cost him and his company when he becomes a target.

Also remember that Buffett has stated more than once in the past that he prefers monopolies in the business world, and it seems by extension, he likes how the government can be played to take advantage of their monopoly in a way to advantage Berkshire Hathaway.

In the end, I think Buffett's legacy is going to suffer for his attempt to prop up Obama and his policies, which is doubtful he would put up with from any executive in his numerous companies.

Buffett isn't stupid by any stretch of the imagination, but he abandoned the ways of his father Howard Buffett long ago, who was a champion of limited government and free markets.

It would have better for Buffett if he would have stuck to what he was best at doing, and not venture into politics, which has now stained his reputation, and brought out against the mainstream of American thinking.

Maybe people should starting thinking of boycotting his companies to show them what they think about his words and actions.

If you're not convinced the directly attacked the Tea Party, you don't see what he actually said. The public anger is being expressed through the Tea party movement, and his attempt to strip the anger away from the movement is a direct attack against it, because the healthy anger is driving the vermin out of office; both Democrats and Republicans.

This is evidently too much for even Warren Buffett to put up with, and he couldn't just leave it alone like he should have.

Buffett's problem is in his later years he has increasingly emerged as a big government backer, and as committed to Keynesianism as anyone around, and uses his popularity to justify outrageous spending, especially by his man Obama.

It makes me wonder if the years he spend building his legacy will crumble from these last years of his life, as America rises up against the things he's supporting and backing.

Recently he made the incredible statement that Americans should quit being angry at the government, and get over it. That was a direct attack on the tea party movement, no matter how it is spun later.

After all, while the majority of Americans are already fed up with the Obama administration and their destructive policies, the tea party is the outlet of that frustration, and for Buffett to outright attack them and their anger, goes beyond his pay grade, as some politician said not that long ago.

Buffett said, "...it is not helpful to have people as unhappy as they are about what’s going on in Washington.”

As Buffett has aged, he doesn't seem as coherent as he was in his youth, and he can make what appears to be contradictory statements about the same issue.

For example, he says we shouldn't be angry, but then says things like this: “The truth is we’re running a federal deficit that’s 9 percent of gross domestic product. That’s stimulative as all get out. It’s more stimulative than any policy we’ve followed since World War II.”

He also recently stated we're still in a recession, something we've continue to say here at Commodity Surge.

So the government is stimulating beyond imagination, stealing from the future of our children and grandchildren, saying they're ready to do it again via the Federal Reserve, but we need to just relax and let the government do what it wants no matter how destructive it is.

Respected or not, Buffett is just another Obama backer who drank the Kool Aid and in a state of being mesmerized, throws away a lot of what he would have opposed in the past.

In reality, it seems Buffett has been afraid of the government because he understands the monopoly it holds, and how it extends beyond its mandate.

That's why if you ever read his Berkshire Hathaway (NYSE:BRK-A) quarterly reports, you'll see he never attacks the outrageous taxes corporations and individuals have to endure from the government, as he knows it'll cost him and his company when he becomes a target.

Also remember that Buffett has stated more than once in the past that he prefers monopolies in the business world, and it seems by extension, he likes how the government can be played to take advantage of their monopoly in a way to advantage Berkshire Hathaway.

In the end, I think Buffett's legacy is going to suffer for his attempt to prop up Obama and his policies, which is doubtful he would put up with from any executive in his numerous companies.

Buffett isn't stupid by any stretch of the imagination, but he abandoned the ways of his father Howard Buffett long ago, who was a champion of limited government and free markets.

It would have better for Buffett if he would have stuck to what he was best at doing, and not venture into politics, which has now stained his reputation, and brought out against the mainstream of American thinking.

Maybe people should starting thinking of boycotting his companies to show them what they think about his words and actions.

If you're not convinced the directly attacked the Tea Party, you don't see what he actually said. The public anger is being expressed through the Tea party movement, and his attempt to strip the anger away from the movement is a direct attack against it, because the healthy anger is driving the vermin out of office; both Democrats and Republicans.

This is evidently too much for even Warren Buffett to put up with, and he couldn't just leave it alone like he should have.

Friday, August 6, 2010

Consumer Credit Drops as US Economy Falters

Government interference in the marketplace has hidden the true weakness of the U.S. economy, and the release of the census workers from their temporary jobs, underscored the reality of the ongoing recession, as 131,000 workers were laid off.

The so-called jobless recovery that never was, has caused consumer credit to drop for the fifth month in a row, this time by 0.7 percent in June, or $1.3 billion.

In April U.S. consumer credit plunged 6.4 percent, and in May it dropped another 2.6 percent.

The lack of job creation in the private sector continues to be the impetus behind consumers pulling back on going into debt, and there is nothing in the short term that indicates this will change; as a matter a fact it'll probably get a lot worse before it begins to turn around.

Picking and choosing the economy data to focus on no longer cuts it, as even at that it brought mixed outlooks, while those that understood knew it was far from mixed, but an outright sham as far as cherry picking what the media chose to emphasize when they reported.

Not only are payrolls weak, but the housing market is almost assuredly going to go into recession again, debt levels remain high, and we haven't even heard much lately about the projected disaster of commercial real estate for the second half of 2010, which could begin at any time, as far as focusing on the issue.

With a job market that could take years to turn around, and the same with housing and commercial real estate, one does have to ask what the optimism is all about.

I think we're going to find out the economic optimism is much ado about nothing.

The so-called jobless recovery that never was, has caused consumer credit to drop for the fifth month in a row, this time by 0.7 percent in June, or $1.3 billion.

In April U.S. consumer credit plunged 6.4 percent, and in May it dropped another 2.6 percent.

The lack of job creation in the private sector continues to be the impetus behind consumers pulling back on going into debt, and there is nothing in the short term that indicates this will change; as a matter a fact it'll probably get a lot worse before it begins to turn around.

Picking and choosing the economy data to focus on no longer cuts it, as even at that it brought mixed outlooks, while those that understood knew it was far from mixed, but an outright sham as far as cherry picking what the media chose to emphasize when they reported.

Not only are payrolls weak, but the housing market is almost assuredly going to go into recession again, debt levels remain high, and we haven't even heard much lately about the projected disaster of commercial real estate for the second half of 2010, which could begin at any time, as far as focusing on the issue.

With a job market that could take years to turn around, and the same with housing and commercial real estate, one does have to ask what the optimism is all about.

I think we're going to find out the economic optimism is much ado about nothing.

Friday, July 2, 2010

US Economy Loses Another 125,000 Jobs in June

As another 125,000 jobs were lost in the American economy in June, questions concerning whether or not the recession has ever ended continue to grow.

The attempt to spin the fall in the unemployment rate from 9.7 percent to 9.5 percent as a positive was neglected by most, as it only signaled people quit looking for jobs, not that jobs were being created.

All this is after over a $1 trillion was thrown out their to "stimulate" the economy. That has completely failed, and the assertion it would have been worse if it hadn't been done isn't provable, and probably false.

What has really happened is it allowed things to extend longer than they should have, and so what should have been allowed to fail wasn't allowed to fail, and now we're going to have to start dealing with the real economy, which is being revealed to be as weak as ever.

One example of that is the tax credit for new home buyers, which after it ran out showed there was little real demand, and consequently sales plunged by about a third once the program ended.

This is why the government and Federal Reserve need to quit interfering and allow the markets to adjust and take care of business, as they know how to adopt strategy and adapt to the economic realities they face, and government interference only skews the market and makes it harder to analyze and work within because of the huge influx of money which shouldn't have been there in the first place.

Once it runs out, like it has now, the market can than look at the real conditions out there and respond accordingly. This is why stimulus programs have historically extended difficult economic times, as they get in the way of those that know how to respond to and handle them: business.

So when it is said that the recovery isn't as strong as expected, that's really not true. What's true is the illusion and fantasy created by distributing printed money into the marketplace has crumbled, and the real condition of the economy is being revealed.

This is why the private sector is creating very little jobs and the government is, as it's simply spending money hiring workers they don't need in able to make the economy look stronger than it is.

The problem with that of course is there are few new jobs and real wealth being created in the private sector to pay for those government jobs, which pay far above market wages as it is, even though they aren't needed in the first place.

As Margaret Thatcher wisely said years ago, the problem with socialism is eventually you run out of someone else's money.

That's what's happening now, as the Obama administration attempted to play that game in hopes the private sector would pick up in job creation. Now that it hasn't, they've created all these government jobs no one can pay for, and now face the problem of further debt because of it.

The attempt to spin the fall in the unemployment rate from 9.7 percent to 9.5 percent as a positive was neglected by most, as it only signaled people quit looking for jobs, not that jobs were being created.

All this is after over a $1 trillion was thrown out their to "stimulate" the economy. That has completely failed, and the assertion it would have been worse if it hadn't been done isn't provable, and probably false.

What has really happened is it allowed things to extend longer than they should have, and so what should have been allowed to fail wasn't allowed to fail, and now we're going to have to start dealing with the real economy, which is being revealed to be as weak as ever.

One example of that is the tax credit for new home buyers, which after it ran out showed there was little real demand, and consequently sales plunged by about a third once the program ended.

This is why the government and Federal Reserve need to quit interfering and allow the markets to adjust and take care of business, as they know how to adopt strategy and adapt to the economic realities they face, and government interference only skews the market and makes it harder to analyze and work within because of the huge influx of money which shouldn't have been there in the first place.

Once it runs out, like it has now, the market can than look at the real conditions out there and respond accordingly. This is why stimulus programs have historically extended difficult economic times, as they get in the way of those that know how to respond to and handle them: business.

So when it is said that the recovery isn't as strong as expected, that's really not true. What's true is the illusion and fantasy created by distributing printed money into the marketplace has crumbled, and the real condition of the economy is being revealed.

This is why the private sector is creating very little jobs and the government is, as it's simply spending money hiring workers they don't need in able to make the economy look stronger than it is.

The problem with that of course is there are few new jobs and real wealth being created in the private sector to pay for those government jobs, which pay far above market wages as it is, even though they aren't needed in the first place.

As Margaret Thatcher wisely said years ago, the problem with socialism is eventually you run out of someone else's money.

That's what's happening now, as the Obama administration attempted to play that game in hopes the private sector would pick up in job creation. Now that it hasn't, they've created all these government jobs no one can pay for, and now face the problem of further debt because of it.

Wednesday, June 9, 2010

IMF: Global Economy At Risk - Contradicts Bernanke

Although his name wasn't mentioned, Ben Bernanke essentially received a rebuke from one official from the IMF, who said risks to the global economy have 'risen significantly.'

While it could be a coincidence, it's doubtful when taking into account it came a day after Bernanke's irresponsible comments that the U.S. economy is doing okay, although it'll take some time to recover strongly.

IMF deputy managing director, Naoyuki Shinohara, said this, “After nearly two years of global economic and financial upheaval, shockwaves are still being felt, as we have seen with recent developments in Europe and the resulting financial market volatility. The global outlook remains unusually uncertain and downside risks have risen significantly.”

So to say America is puttering along at a decent pace in light of this is ludicrous, and ultimately dishonest of Bernanke, who knows better, and is still trying to salvage his legacy, which is sure to be horrid for what he's done to the economy and debt load of the United States through his policies at the Federal Reserve.

While it could be a coincidence, it's doubtful when taking into account it came a day after Bernanke's irresponsible comments that the U.S. economy is doing okay, although it'll take some time to recover strongly.

IMF deputy managing director, Naoyuki Shinohara, said this, “After nearly two years of global economic and financial upheaval, shockwaves are still being felt, as we have seen with recent developments in Europe and the resulting financial market volatility. The global outlook remains unusually uncertain and downside risks have risen significantly.”

So to say America is puttering along at a decent pace in light of this is ludicrous, and ultimately dishonest of Bernanke, who knows better, and is still trying to salvage his legacy, which is sure to be horrid for what he's done to the economy and debt load of the United States through his policies at the Federal Reserve.

Friday, April 9, 2010

Gold Continues to Ignore Dollar

Gold ignoring U.S. dollar

Maybe more than any other time in recent history, gold has decoupled from its usual inverse relationship to the U.S. dollar and is standing on its own as an alternative form of currency.

While most say that will change when interest rates change in the U.S. and the dollar strengthens, I'm not sure that will be completely true.

I'm not saying it won't happen, but something has changed in the mindset of investors in reference to paper currencies, and it remains to be seen whether that change holds or not when circumstances change to favor the dollar. What remains to be seen is if gold has a floor under which will last for years into the future, no matter what happens to the dollar.

Investors and the general public are gradually learning the weakness of continuing to print money out of thin air, and even when interest rates increase there's the likelihood that inflation will too, adding another element to the overall performance of gold, and that doesn't take into account the potential European fiasco that may unfold in the next year or two, of which Greece is only a small part of it.

There are too many variables because of the economic and banking crisis which are unique to our time, and we really don't know where things will end up, and that makes gold even more attractive going into the cloudy future.

Maybe more than any other time in recent history, gold has decoupled from its usual inverse relationship to the U.S. dollar and is standing on its own as an alternative form of currency.

While most say that will change when interest rates change in the U.S. and the dollar strengthens, I'm not sure that will be completely true.

I'm not saying it won't happen, but something has changed in the mindset of investors in reference to paper currencies, and it remains to be seen whether that change holds or not when circumstances change to favor the dollar. What remains to be seen is if gold has a floor under which will last for years into the future, no matter what happens to the dollar.

Investors and the general public are gradually learning the weakness of continuing to print money out of thin air, and even when interest rates increase there's the likelihood that inflation will too, adding another element to the overall performance of gold, and that doesn't take into account the potential European fiasco that may unfold in the next year or two, of which Greece is only a small part of it.

There are too many variables because of the economic and banking crisis which are unique to our time, and we really don't know where things will end up, and that makes gold even more attractive going into the cloudy future.

Thursday, April 8, 2010

US Jobless Claims Rise Last Week

I always include this as part of the economic data talked about here on Commodity Surge, as the inclusion of the term unexpected, again, has been applied to the increase, in this case, of jobless claims.

Every time this is said, it's a form of manipulation to imply it's a shock that things are bad, when in fact there really has never been a true recovery, and we're still in the midst of a recession. This is why the term unexpected is used, to make it look like it's not the norm, when if fact it actually is.

Anyway, the number of jobless claims rose by 18,000 to reach 460,000 last week ending on April 3, according to data released from the Labor Department.

Analysts were surprised by the data, but I'm not sure why. Are they believing their own hype and wishful thinking? Are they in complete denial? It seems so.

This isn't rocket science, and the idea we have turned the corner in the recession is one that is based on theory and not reality, as these jobless claims numbers show. Quit pretending it's unexpected, as you can only save that word so many times before you look incompetent or like you're outright lying.

Every time this is said, it's a form of manipulation to imply it's a shock that things are bad, when in fact there really has never been a true recovery, and we're still in the midst of a recession. This is why the term unexpected is used, to make it look like it's not the norm, when if fact it actually is.

Anyway, the number of jobless claims rose by 18,000 to reach 460,000 last week ending on April 3, according to data released from the Labor Department.

Analysts were surprised by the data, but I'm not sure why. Are they believing their own hype and wishful thinking? Are they in complete denial? It seems so.

This isn't rocket science, and the idea we have turned the corner in the recession is one that is based on theory and not reality, as these jobless claims numbers show. Quit pretending it's unexpected, as you can only save that word so many times before you look incompetent or like you're outright lying.

Monday, February 8, 2010

Marc Faber: US Bankrupt 10 Years

Marc Faber - US going bankrupt

Marc Faber states in about 10 years over 35 percent of tax revenues collected in the United States will have to be used to pay off the U.S. debt.

“Maximum within 10 years time more than 35% of tax revenues will have to be used to pay the interest on the government debt and then you are in trouble – because then there will be not enough money out of the budget to pay for other stuff. I’m convinced the US government will go bankrupt, but not tomorrow. And before they go bankrupt, they’ll print money, and then you get high inflation rates, you have a depression and eventually they’ll go to war,” said Faber

He also believes the credit rating of the U.S. could fall below its top rated 'A' status, especially if the economy grows much slower than estimates, and the more information that comes out, the more a reality that seems to be.

Inflation is coming, it's only a matter of when it becomes noticeable. Some prices are already significantly higher, but they're balanced by the drop in others. Pretty soon that scenario won't be able to survive in the realities ahead of us, and then the unthinkable will happen.

Marc Faber - US going bankrupt

Marc Faber states in about 10 years over 35 percent of tax revenues collected in the United States will have to be used to pay off the U.S. debt.

“Maximum within 10 years time more than 35% of tax revenues will have to be used to pay the interest on the government debt and then you are in trouble – because then there will be not enough money out of the budget to pay for other stuff. I’m convinced the US government will go bankrupt, but not tomorrow. And before they go bankrupt, they’ll print money, and then you get high inflation rates, you have a depression and eventually they’ll go to war,” said Faber

He also believes the credit rating of the U.S. could fall below its top rated 'A' status, especially if the economy grows much slower than estimates, and the more information that comes out, the more a reality that seems to be.

Inflation is coming, it's only a matter of when it becomes noticeable. Some prices are already significantly higher, but they're balanced by the drop in others. Pretty soon that scenario won't be able to survive in the realities ahead of us, and then the unthinkable will happen.

Marc Faber - US going bankrupt

Sunday, December 13, 2009

Peter Schiff: Dollar Collapse Soon

Peter Schiff believes the collapse of the U.S. dollar is imminent, and that it'll happen sooner rather than later. He believes it will happen before Obama leaves office, even if he's a one-term president.

Schiff is quick to add the U.S. dollar won't fall every day or period of time, but its overall trajectory will be down, and even with some periods of strengthening, there's nothing to keep it on it precipitous fall off the edge of the cliff.

Part of the reason the U.S. dollar hasn't completely collapsed, according to Schiff, is the continual investment of foreign governments to keep it strong.

For those governments, if the dollar falls too much, it will have a negative impact on their exports, which would of course hurt their domestic economies. So they continue to invest in the dollar through buying up U.S. debt in hopes there will be an actual rebound in the value of the greenback from market forces.

The longer foreign governments prop up the dollar, the longer there will be large global imbalances, which won't be solved until the U.S. dollar falls in value.

When the dollar loses value, the price of everything goes up, as it takes more dollars to buy the same thing. This will be true of everything; including commodities.

Food and energy usually lead the cost increases, and that has consequences because if people are spending most of their money on food and energy, they have much less, if any, to spend on other products and services.

This could affect corporations in the U.S. because if the cost of debt begins to rise and consumers aren't spending money on their products, you'll eventually see the share prices of stocks fall along with the value of the U.S. dollar as it collapses.

Schiff is quick to add the U.S. dollar won't fall every day or period of time, but its overall trajectory will be down, and even with some periods of strengthening, there's nothing to keep it on it precipitous fall off the edge of the cliff.

Part of the reason the U.S. dollar hasn't completely collapsed, according to Schiff, is the continual investment of foreign governments to keep it strong.

For those governments, if the dollar falls too much, it will have a negative impact on their exports, which would of course hurt their domestic economies. So they continue to invest in the dollar through buying up U.S. debt in hopes there will be an actual rebound in the value of the greenback from market forces.

The longer foreign governments prop up the dollar, the longer there will be large global imbalances, which won't be solved until the U.S. dollar falls in value.

When the dollar loses value, the price of everything goes up, as it takes more dollars to buy the same thing. This will be true of everything; including commodities.

Food and energy usually lead the cost increases, and that has consequences because if people are spending most of their money on food and energy, they have much less, if any, to spend on other products and services.

This could affect corporations in the U.S. because if the cost of debt begins to rise and consumers aren't spending money on their products, you'll eventually see the share prices of stocks fall along with the value of the U.S. dollar as it collapses.

Labels:

Peter Schiff,

US Dollar,

US Dollar Collapse,

US Economy

Wednesday, October 7, 2009

Commodities Rise on Dollar Collapse

As the U.S. dollar continues to plunge in value, commodities and stocks related to commodities continue rise in price, as investors flee the greenback and look to energy, raw materials and related stocks to hedge against its continuing demise.

Also benefiting from the fall of the U.S. dollar are multinational companies, which are also targets of investors. Of course foreign manufacturers are getting nervous, as their products are costing more with the collapse of the dollar, and they lose sales as their price competitiveness in America declines.

Most believe the stock market will remain volatile for some time, and will largely move in conjunction with the ups and downs of the U.S. dollar, which means it'll probably move up as the dollar over the long term moves down.

Taking into account the flight to safety and hedge against inflation, along with the ongoing collapse of the U.S. dollar, and the emerging middle classes in China, India, and other places in Asia, and you can see why commodities will continue to soar for years into the future.

Also benefiting from the fall of the U.S. dollar are multinational companies, which are also targets of investors. Of course foreign manufacturers are getting nervous, as their products are costing more with the collapse of the dollar, and they lose sales as their price competitiveness in America declines.

Most believe the stock market will remain volatile for some time, and will largely move in conjunction with the ups and downs of the U.S. dollar, which means it'll probably move up as the dollar over the long term moves down.

Taking into account the flight to safety and hedge against inflation, along with the ongoing collapse of the U.S. dollar, and the emerging middle classes in China, India, and other places in Asia, and you can see why commodities will continue to soar for years into the future.

Saturday, January 24, 2009

Commodities: Oil Prices Rise

There are a number of variables involved with the overall commodity sector, and oil is affected just as much as all the commodities.

Some of the obvious factors are the economic slowdown, forced liquidation and deleveraging that have had the type of impact that has caused commodities to be very volatile, in contrast to their normal predictable behavior in an economic slump.

For example, gold would usually be considered the place for investors to put their money when recession times like this are upon us. But gold hasn't skyrocketed the way it normally would have, although signs are it's starting to do that now, along with silver, platinum and other precious metals.

Oil prices especially are affected by the economy, as consumers stay home rather than using their disposable income on gas. That has caused oil stockpiles to rise and prices to plunge. The oil surplus has alos caused gas prices to fall in a major way as well.

In an attempt to put a halt to the surplus, OPEC is cutting oil production even more in an effort to shore up prices. Oil companies have cut back on drilling too, as the lower prices keep them from keeping too many wells in production.

Even though stocks have risen a little recently, traders are starting to look again to commodities as their choice of investment. U.S. dollar related investments are becoming increasingly risky in this environment, as the government goes into horrid debt, which the Federal Reserve will have to pay for by keeping the printing presses running full time.

Those who think the proposed Obama stimulus plan will change this are in for a big surprise, as it will only add fuel to the fire, and will do nothing to help the market. In truth, the market doesn't need to be helped, and the Obama big government machine needs to realize that.

While futures traders are looking more favorably at precious metals, they're puzzled about oil, as it seems many are attempting to make it look like it's going to continue to go up, but the underlying fundamentals aren't pointing that way.

No matter what OPEC or others attempt to do to inflate the prices, the higher oil goes, the less people will buy. Demand will go down, and prices with it. What will the government do, implement oil price controls? That's already proven to be a horrible failure which will launch oil shortages. History has proven this is always the result of price controls.

Consequently, the idea that oil stockplies will decline is ludicrous, for the reasons stated above. People holding tight to their money aren't going to change their habits when oil prices rise. They didn't do it when prices had plunged far below the current levels.

To underscore that, even as oil prices have risen for a couple weeks, so has crude inventories in the U.S., rising by 14 million barrels in just three weeks, says the Department of Energy's Energy Information Administration.

I'm not sure where oil industry watchers think the commodity will continue to rise, but it's a fallacy, and those betting on it are going to lose big time.

Some people think oil is totally unpredictable, as they're moving away from supply and demand, and instead are looking at governments who are attempting to game the market by their bailouts and cutting of oil production. Those artificial efforts are useless.

Commodity prices will rise in 2009, but oil won't be included in that basket. It may rise some, but the trend will continue for some time. It's moving lockstep with the economy, and people have stopped spending their money on travel. Nothing a government can do will change that reality.

Oil is one commodity I would short. Unless there's something unknown that happens, that will be the reality for some time to come.

Some of the obvious factors are the economic slowdown, forced liquidation and deleveraging that have had the type of impact that has caused commodities to be very volatile, in contrast to their normal predictable behavior in an economic slump.

For example, gold would usually be considered the place for investors to put their money when recession times like this are upon us. But gold hasn't skyrocketed the way it normally would have, although signs are it's starting to do that now, along with silver, platinum and other precious metals.

Oil prices especially are affected by the economy, as consumers stay home rather than using their disposable income on gas. That has caused oil stockpiles to rise and prices to plunge. The oil surplus has alos caused gas prices to fall in a major way as well.

In an attempt to put a halt to the surplus, OPEC is cutting oil production even more in an effort to shore up prices. Oil companies have cut back on drilling too, as the lower prices keep them from keeping too many wells in production.

Even though stocks have risen a little recently, traders are starting to look again to commodities as their choice of investment. U.S. dollar related investments are becoming increasingly risky in this environment, as the government goes into horrid debt, which the Federal Reserve will have to pay for by keeping the printing presses running full time.

Those who think the proposed Obama stimulus plan will change this are in for a big surprise, as it will only add fuel to the fire, and will do nothing to help the market. In truth, the market doesn't need to be helped, and the Obama big government machine needs to realize that.

While futures traders are looking more favorably at precious metals, they're puzzled about oil, as it seems many are attempting to make it look like it's going to continue to go up, but the underlying fundamentals aren't pointing that way.

No matter what OPEC or others attempt to do to inflate the prices, the higher oil goes, the less people will buy. Demand will go down, and prices with it. What will the government do, implement oil price controls? That's already proven to be a horrible failure which will launch oil shortages. History has proven this is always the result of price controls.

Consequently, the idea that oil stockplies will decline is ludicrous, for the reasons stated above. People holding tight to their money aren't going to change their habits when oil prices rise. They didn't do it when prices had plunged far below the current levels.

To underscore that, even as oil prices have risen for a couple weeks, so has crude inventories in the U.S., rising by 14 million barrels in just three weeks, says the Department of Energy's Energy Information Administration.

I'm not sure where oil industry watchers think the commodity will continue to rise, but it's a fallacy, and those betting on it are going to lose big time.

Some people think oil is totally unpredictable, as they're moving away from supply and demand, and instead are looking at governments who are attempting to game the market by their bailouts and cutting of oil production. Those artificial efforts are useless.

Commodity prices will rise in 2009, but oil won't be included in that basket. It may rise some, but the trend will continue for some time. It's moving lockstep with the economy, and people have stopped spending their money on travel. Nothing a government can do will change that reality.

Oil is one commodity I would short. Unless there's something unknown that happens, that will be the reality for some time to come.

Saturday, November 22, 2008

Commodities: Barack Obama Disaster for Economy

Why Barack Obama will be disaster for commodities and economy

At the World Money Show, Jim Rogers told those in attendance that if Barack Obama follows through with his two policies concerning the economy, it'll be a disaster.

The two misguided policies, according to Obama's rhetoric, are to tax capital when it is at its weakest, and secondly, he wants to protect American jobs.

According to Rogers, the only thing that will help America is if Obama is indeed just throwing around rhetoric. If he actually follows through with them, it'll make the American economy even more unhealthy.

Rogers is right when saying both of these ignorant steps are rewarding the incompetent at the expense of the competent. That's what happens when people vote in the most inexperienced candidate in history. Sarah Palin was far more experienced in running an economy than Obama is or will be.

As far as investments go, Rogers asserts the commodity decline is a temporary blip, and overall it'll extend the commodity bull market rather than end it.

Concerning the U.S. dollar, Rogers adds that the currency rally is a short-term phenomena, and U.S. debt and business failures ensure it will also end soon. Rogers says we should bet against the U.S. dollar, along with long-term U.S. bonds.

Commodities he's bullish on are sugar, cotton and gold. For oil he likes African stocks, primarily those in Angola.

At the World Money Show, Jim Rogers told those in attendance that if Barack Obama follows through with his two policies concerning the economy, it'll be a disaster.

The two misguided policies, according to Obama's rhetoric, are to tax capital when it is at its weakest, and secondly, he wants to protect American jobs.

According to Rogers, the only thing that will help America is if Obama is indeed just throwing around rhetoric. If he actually follows through with them, it'll make the American economy even more unhealthy.

Rogers is right when saying both of these ignorant steps are rewarding the incompetent at the expense of the competent. That's what happens when people vote in the most inexperienced candidate in history. Sarah Palin was far more experienced in running an economy than Obama is or will be.

As far as investments go, Rogers asserts the commodity decline is a temporary blip, and overall it'll extend the commodity bull market rather than end it.

Concerning the U.S. dollar, Rogers adds that the currency rally is a short-term phenomena, and U.S. debt and business failures ensure it will also end soon. Rogers says we should bet against the U.S. dollar, along with long-term U.S. bonds.

Commodities he's bullish on are sugar, cotton and gold. For oil he likes African stocks, primarily those in Angola.

Friday, November 14, 2008

Commodity: China's Stimulus Plan and U.S. Dollar

What will be the effect of China stimulus plan on U.S. dollar as commodity?

A number of analysts have commented on the large number of factories that have closed in China, and think this will have such a negative impact on the country that it will lead to a depression there.

With that in mind, let's look at the recent announcement they're going to offer a stimulus package worth about $585 billion.

The reason the stimulus package of China is important to the U.S. dollar is money which would in the recent past been invested in the greenback through buying up U.S. treasuries, will now be put aside for Chinese domestic infrastructure projects.

China has been behind the available money for the U.S consumer to continue indulging in their reckless spending, that will start to change as China spreads its risk out more through now focusing on building up its domestic economy. The idea is to decouple from the export reliance it has had in order to put its people to work in factories and build up national wealth.

Now that it is accomplished, they will now change that overall strategy to focus within. They are also employing a similar strategy in Brazil, as they recently received permission for the Bank of China to have a direct presence in the country in order to offer financing for Chinese businesses who want to work of Brazilian infrastructure projects.

As this begins to play itself over the next two years (the Chinese stimulus time frame), it should put downward pressure on the U.S. dollar. Couple that with having to pay back the outrageous and ignorant stimulus package in the U.S., and we'll see heightened inflation and a weaker dollar going ahead.

Add all that to the current deleveraging of American funds at this time which has helped strengthen the U.S. dollar, and we could see a tremendous plunge in its value. It's a matter of when, not if.

A major question is whether the U.S. dollar will remain the denominated currency for commodities.

A number of analysts have commented on the large number of factories that have closed in China, and think this will have such a negative impact on the country that it will lead to a depression there.

With that in mind, let's look at the recent announcement they're going to offer a stimulus package worth about $585 billion.

The reason the stimulus package of China is important to the U.S. dollar is money which would in the recent past been invested in the greenback through buying up U.S. treasuries, will now be put aside for Chinese domestic infrastructure projects.

China has been behind the available money for the U.S consumer to continue indulging in their reckless spending, that will start to change as China spreads its risk out more through now focusing on building up its domestic economy. The idea is to decouple from the export reliance it has had in order to put its people to work in factories and build up national wealth.

Now that it is accomplished, they will now change that overall strategy to focus within. They are also employing a similar strategy in Brazil, as they recently received permission for the Bank of China to have a direct presence in the country in order to offer financing for Chinese businesses who want to work of Brazilian infrastructure projects.

As this begins to play itself over the next two years (the Chinese stimulus time frame), it should put downward pressure on the U.S. dollar. Couple that with having to pay back the outrageous and ignorant stimulus package in the U.S., and we'll see heightened inflation and a weaker dollar going ahead.

Add all that to the current deleveraging of American funds at this time which has helped strengthen the U.S. dollar, and we could see a tremendous plunge in its value. It's a matter of when, not if.

A major question is whether the U.S. dollar will remain the denominated currency for commodities.

Wednesday, November 12, 2008

Henry Paulson Announcement Sends Investors Fleeing to Safety

With traders and investors in a risk-adverse mode, anything they're unsure of sends running for safety and cover, and it was no different today.

When U.S. Treasury Secretary Henry Paulson announced the Troubled Asset Relief Program (TARP) would now be adding those in the nonbanking sector to their focus, investors fleed to the U.S. dollar and yen for protection.

The underlying assumption being made was things may not be as fixable through TARP than they orginally thought, and unexpected problems may be hindering the effort.

Right after Paulson's remarks went across the news wires, the stampede to the yen and U.S. dollar began.

The dollar and yen remain the investment of choice for those seeking safety, although the yen is getting more activity and holding strong, as the dollar fell Wednesday to 94.61 yen from 97.60.

When U.S. Treasury Secretary Henry Paulson announced the Troubled Asset Relief Program (TARP) would now be adding those in the nonbanking sector to their focus, investors fleed to the U.S. dollar and yen for protection.

The underlying assumption being made was things may not be as fixable through TARP than they orginally thought, and unexpected problems may be hindering the effort.

Right after Paulson's remarks went across the news wires, the stampede to the yen and U.S. dollar began.

The dollar and yen remain the investment of choice for those seeking safety, although the yen is getting more activity and holding strong, as the dollar fell Wednesday to 94.61 yen from 97.60.

Tuesday, November 11, 2008

Commodities: Mirror Equities Drop

Commodities mirror drop of equities

Almost everything in the current market are acting like they're in a conspiracy against commodities, as they go against their usual behavior and drop along with stocks. Investors usually use them as a hedge when the equities market falls, but this time around there's no safety there.

Once the period of deleveraging dissipates we'll get a better picture on whether that's the major downward pressure on raw materials. It's definitely one of the key reasons commodities are underperforming, as funds are forced to sell in order to access capital.

Of course this also increases the strength of the U.S. dollar, which in turn puts more downward pressure on commodities, as when funds move out of their positions in commodities, it brings them back to the U.S. dollar which most are denominated in.

The other obvious reason for the ongoing plunge in commodity prices is the economic conditions themselves, where demand for raw materials has declined significantly. This is one of the major reasons China is putting their own stimulous package into play, to spur domestic growth by providing capital for infrastructure projects.

When forced liquidation (deleveraging) begins to slow down, that'll probably be the first step toward shoring up the raw materials market again.

All of these factors will continue to drive the prices of commodities across the board.

Almost everything in the current market are acting like they're in a conspiracy against commodities, as they go against their usual behavior and drop along with stocks. Investors usually use them as a hedge when the equities market falls, but this time around there's no safety there.

Once the period of deleveraging dissipates we'll get a better picture on whether that's the major downward pressure on raw materials. It's definitely one of the key reasons commodities are underperforming, as funds are forced to sell in order to access capital.

Of course this also increases the strength of the U.S. dollar, which in turn puts more downward pressure on commodities, as when funds move out of their positions in commodities, it brings them back to the U.S. dollar which most are denominated in.

The other obvious reason for the ongoing plunge in commodity prices is the economic conditions themselves, where demand for raw materials has declined significantly. This is one of the major reasons China is putting their own stimulous package into play, to spur domestic growth by providing capital for infrastructure projects.

When forced liquidation (deleveraging) begins to slow down, that'll probably be the first step toward shoring up the raw materials market again.

All of these factors will continue to drive the prices of commodities across the board.

Thursday, October 23, 2008

Alan Greenspan "Shocked" at Depth of U.S. Credit Breakdown

In one of the most pathetic comments I've ever heard from an alleged financial expert, former Federal Reserve Chairman Alan Greenspan told Congress Thursday that he was "shocked" at the depth of the breakdown in the U.S. credit markets.

If that's not bad enough, now Greenspan, who formerly opposed government regulation, has found government religion, as he is saying (under pressure) that he was "'partially' wrong in his belief that some trading instruments, specifically credit default swaps, did not need oversight."

While many big-government politicians are attempting to hide the government's direct culpability in the worldwide disaster, the only politician that understands what is going on, Ron Paul, had this to say about more government interference:

"In the midst of highly unpopular bailouts of Wall Street, many justifications have been given about why Washington feels the need to act. Some claim that capitalism and the free market are to blame, but we have not had capitalism. If you compare our financial capital to our aggregate debt, this would be obvious. In the same way, we have not had a truly free market. The monetary manipulations of the Federal Reserve, a complex tax code, the many 'oversight' agencies and their mountains of regulations show that we are far removed from a free market economy."

Additional regulation is being touted to hide the fact that all this is the fault of the government in the first place. Now they're making it look like the free market is the problem, when in reality it's the abandonment of the free market that has driven this fiasco.

To get more specific, Democrats are in particular to blame for this because they pressured Freddie Mac and Fannie Mae to offer the sub-prime loans to unqualified buyers, which when they did, overall led to this disaster. Now the outrageous Democrats are trying to add more regulation to the mix, setting the nation and world up for something worse in the future.

This is the old socialist idea that everyone needs to be equal: eqalitarianism. The problem is this is a false premise, and a idealistic notion that has failed over and over again in the past, as there is a reason many people aren't able to buy homes or other financially related things: they aren't able to manage the responsibility.

Get people with no personal financial management understanding or ability into a house they can barely afford, and you have set them up for failure; they don't even think in terms of repairs or outrageous increases in taxes.

Here's how Greenspan described what happened:

"Without the excess demand from securitizers, subprime mortgage originations -- undeniably the original source of crisis -- would have been far smaller and defaults, accordingly, far fewer.

"A surge in demand for U.S. subprime securities, supported by unrealistically positive ratings by credit agencies, was the core of the problem."

What did he just admit? He admitted that government pressure to get people in homes is the underlying problem of the credit crisis. That's what he really said in words most Americans won't understand, so he felt safe to say it.