It's incredible to me to see the financial media portray the American economy as one that is in a sustainable recovery. Data and facts are selectively reported and manipulated to present the strongest economy possible without media being considered nonsensical.

I don't mean by that there isn't any reporting of the negative economic facts, as the mainstream media wouldn't even be taken half seriously if they weren't. Yet in the majority of cases there are omissions concerning the analysis of the data. For example, with the recent unemployment numbers, where what was highlighted was the drop in the number of unemployed, but not why that was a disaster rather than a positive outcome.

The over emphasis of one element of the economic data, while minimizing another, is the game being played in the financial media now, one all investors must recognize in order to protect their capital.

Politics, Media and the Economy

What must be acknowledged and understood is the media in general have migrated their political way of reporting into the financial realm. That means because there are certain things networks, reporters and writers believe, they allow that to dictate how they present the news and data, and how it is written, to bolster their own political outlook and beliefs.

I don't care, but I'll get a few of you riled up here: this is especially true with liberals. The point isn't politics though in this article, and whether you're a liberal or not, it must be understood that politics has mixed in thoroughly with the economic and financial, and it's difficult to extricate them when looking for actionable data and news from media outlets.

For example, if you have liberal political leanings, it isn't the purpose of this article to point to the political side of it, but to help you to understand when media you would agree with when talking politics transfer their focus to economics and business, you have to be careful not to drink in the reporting in a way you would when engaging with a political campaign. Most people recognize all the hoopla and exaggerations of politicians and their aides, but it's not as identifiable when the writing or reporting migrates to business. This is especially true concerning the condition of the American and global economy, which reflects directly on a President and the party in power.

No matter what your political persuasion, be careful of financial reporting, especially in relationship to the economy. You also have to careful in regard to certain sectors that are political magnets, such as energy.

Agreeing with the world view of a writer, reporter or news outlet is completely different than looking objectively at the hard data.

Quick Example

Just to give you an idea how financial data can be reported as better than expected, here's how the recent data concerning the devastating drop in durable good orders was presented.

The decline in orders is the latest in a string of reports that suggest the manufacturing sector cooled off a bit toward the end of the first quarter - along with the broader economy.

As is often the case, a large swing in monthly orders for large and expensive commercial aircraft exaggerated the headline number on durable goods.

Notice how the huge 5.7 percent drop in durable goods was presented as this: "the manufacturing sector cooled off a bit." Below that the drop in monthly orders in commercial aircraft "exaggerates" the numbers associated with durable goods. This is irresponsible reporting at best, yet most people don't even see the subtle way the data is skewed to look far less ominous than it is.

Throughout the article most data are minimized, until finally near the end the revelation durable goods orders are revealed to be significantly downwardly revised for February, being lowered for a gain of 5.6 percent to a lower gain of 4.3 percent. That is a big difference, yet it's reported with no commentary and a noticeably absent shrug.

Unemployment Numbers and the Economy

Now let's look at the latest unemployment numbers. The U.S. Bureau of Labor Statistics reported the economy added 165,000 jobs in the prior month, while the unemployment rate fall 0.1 percent to 7.5 percent. That means the U.S. economy is chugging along nicely right? Wrong.

• barely keeps up with population;

• features mostly temp workers;

• leaves out prime-age males and all young workers;

• and keeps labor participation rate at a low level from 1979.

The temp workers are the most interesting to me. [It's a direct result of Obamacare,] whereby companies are protecting themselves by starting to hire temporary or part-time workers.

Consequently, a number of workers then go out and get a second job, giving the appearance there is more participation in the workplace than there really is, as well as more hiring being done than is the reality, as far as new workers entering the work force goes.

All of this must be properly identified and assessed by investors looking for data that give them as realistic as a look at what is really happening.

When all is said and done concerning jobs numbers, they are still all estimates, even when there are revisions to original data.

Besides all that, a big portion of the lower unemployment numbers come from those simply leaving the job market altogether; they're no longer looking for a job. At this point in time lower unemployment data are an irrelevant metric for investors and the health of the economy. That will remain that way until meaningful, full-time jobs are created.

Durable Goods Orders

The importance of durable goods data are they reflect how far beyond core staples Americans are acquiring. Lower durable goods orders mean they consumers are spending primarily based upon needs and not wants. It's not a sign of economic growth by any stretch of the imagination.

It also implies the lack of willingness of people to commit to long-term purchases of more expensive items. These include furniture, appliances, and heavy machinery, among many other products.

Two segments in durable goods orders that improved were orders for communications equipment and computers. Autos and auto parts saw a slight increase in orders, but that was only 0.2 percent, the lowest orders so far in 2013.

While not the pervue of this article, the boost in tech-related orders confirms my outlook for the big tech companies, which is they are about to soar.

Overall though, the drop in durable goods orders points to a cautious outlook, one that doesn't strengthen the idea we're in any type of real and sustainable recovery.

Orders for durable goods fell 5.7 percent.

Company Earnings

Another key factor in assessing the real condition of the American economy is what the earnings results really represent for publicly traded companies. While earnings are being touted in many cases during this earnings season, the reality is the majority of those earnings are from cutting costs rather than growth.

Companies are cutting to maintain an appearance of health, while they wait and hope for the economy to experience real growth.

If the economy doesn't pick up this will be exposed, as there isn't that much more companies can do to lower costs, as many have cut as close to the bone as they can.

Other than the occasional exception, the earnings of companies aren't something that can be relied upon, other than pointing to management doing what it can in a very weak economy to generate earnings.

The Federal Reserve has the Pedal to the Metal

If the economy were really doing that well, there would of course be no need for the Federal Reserve to continue to create money out of thin air. The fact that it has no intention of stopping stimulus measures points to the reality that the economy can't stand on its own, and when you look at the results of the stimulus, can't grow either.

What's disconcerting there is the Fed and Ben Bernanke continue to do the same thing with no positive results. What they need to do is take a step back and look deeper into the causes of no real growth after the creation of trillions of dollars.

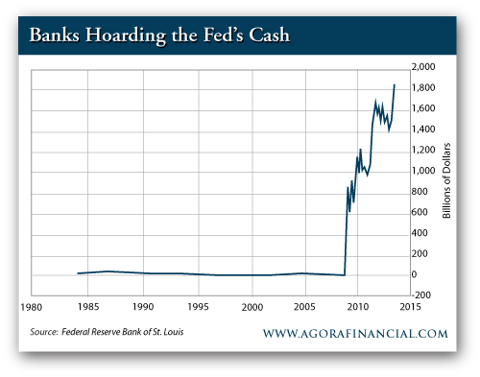

One of the more obvious problems is banks aren't spending the created money, they're hoarding it while also using it to shore up their balance sheets. It's not reaching consumers or others wanting access to the capital.

All the money provides cover and the illusion of recovery, but if trillions do little or nothing to help, how can the creation of more money bring about different results?

Just picture banks and the government digging a pair of holes together using shovels. They both dig a hole, and then each throws the dirt they shoveled into the hole the other dug. That's the basic story of banks and the Fed at this time. It's simply done over and over again with the end result always the same. Maybe that's those shovel-ready jobs the administration has been talking about.

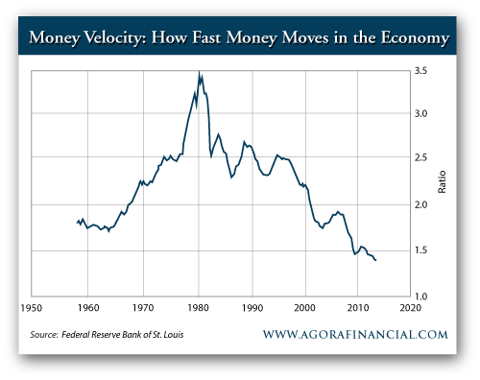

Money Velocity

One metric few investors consider or know about is that of money velocity. What this represents is the pace at which money is spent. This is one of the numerous things Keynesian money creation has no control over. Only those borrowing and spending have power to determine this, and it's totally related to the choices of those with capital at their disposal.

As inflation has dropped over the last 3 decades, so also has the velocity as which people spend money. This is a major factor in real economic growth, one that stimulus supporters don't want the average person to know about or consider. Those of us wanting to understand the health of the economy need to know this.

Lower Interest Rates

From all of this you may think I'm about to go into bearish mode for equities, but I'm not. The reason is there is another key element in the economic and investing picture, and that is low interest rates.

What that has done has pressured many investors out of what would have been considered safe cash investments, and moved them into equities. That's why there has been such a strong move in blue chip stocks with a good dividend record over the last year or so. Unless money is allowed to sit and do nothing in an extremely low-interest account or investment, it must be put to use somewhere. Over the last 12 months that has been blue chip stocks.

Those include Proctor & Gamble (PG), Kraft Foods Inc. (KRFT), 3M Company (MMM) and Merck & Co. (MRK), among many others.

Performances of the stocks over the last year are shown below.

3M

Kraft

Merck

Proctor & Gamble

The reason for showing these is to confirm people have been investing in blue chip stocks over the last year or so in lieu of placing money in banks, CDs, money market funds, and other non-producing financial instruments.

Obviously not everyone is doing this, but a large portion are, which has been the major impetus behind the climb in blue chips during a weak economy. It appears that blue chip period is starting to wane, with a new focus on big tech stocks emerging as the investment of choice.

All of this is to say it's the consequence of low interest rates, which have forced a lot of money into equities that wouldn't have otherwise been there.

During the next couple of years we'll probably see money travel about to different sectors of the market until those particular sectors exhaust themselves. At that time capital will find a new home. Also during this time it looks like each step will include a little more risk tolerance, which is why the recent upward tick in large tech stocks appears to be the next place investors will park their money.

Some big tech stocks moving up since the middle of April include Apple (AAPL), salesforce.com, inc (CRM), Microsoft (MSFT) and IBM (IBM). I would look for low forward price-to-earnings ratios and good entry points. Since it looks like this sector is about to take off, entry points look good right now.

No matter how much money the Federal Reserve or other central banks print, it's only if the money is spent which will determine the economic effect. That means the Fed really has limited power, and only the low interest rates have resulted in investors pouring money into equities, creating the illusion of prosperity and confidence.

The truth is consumer confidence is anemic, and that is evidenced by the hard data of the drop in durable good orders, which points to the fact consumers are also hoarding their money, using it for necessities of life rather than higher-priced items.

Conclusion

This article wasn't meant to be an exhaustive look at the American economy, but enough to show there are forces at work to make it look stronger than it really is. That includes media reports, skewed government data, a lack of understanding of effects of the Federal Reserve, and how low interest rates are driving the investment of capital.

What kind of recovery doesn't create jobs, has one of the slowest rates of growth in modern history, includes falling incomes, and includes little small business creation?

The reason for all of this is the Federal Reserve refused to allow the economy to take its natural course and cleanse itself out, which would have resulted in a more healthy economy going forward. Instead Bernanke and others got a messianic complex and decided we just shouldn't be allowed to experience the normal process of some temporary economic pain. That has produced where we are today, and the practices continue on. It's not going to end well when it all collapses.

What will happen in the short term (next couple of years) is what's relevant to investors. Money always finds a place to work, and the low interest rate environment, which will continue on for some time, is pushing people to put their money in investment vehicles they normally wouldn't have.

We need to watch the trends as they unfold, with the blue chip stock trend starting to wind down and the large tech stock trend starting to unfold. Once the tech stock trend slows down, money will look for another place to land. That probably won't be for another year or so, assuming the tech trend lasts as long as the blue chip trend did.

That's not to say some blue chips won't continue to climb, as some appear to be. But a number of them have reversed direction over the last couple of weeks right at the time the large tech stocks have started to rise. That suggest the money has been taken out of a lot of blue chips and reallocated to big tech. The trend has started, and I don't think this current cycle of investing is going to stop for some time. Money is simply going to migrate from sector to sector as risk tolerance increases. I think that gives a hint as to where money will go after the tech trend is over.

If this is the scenario, why be concerned about the American economy then? The reason is it is still being propped up by smoke and mirrors, and has very little foundational strength behind it. We must understand that even as we continue to stay in the market.

It also means the scenario can change very quickly when a central bank is printing money like it is today. We are in uncharted territory, and when most data point to fearful consumers and weak job numbers, we need to admit the economy is like a big house we built using a deck of cards. An unexpected wind could easily blow it all down.

When reading news stories and reports, we have to, more than ever, read and digest the terminology used and hard data reported. The hard data needs to be what we pay attention to, not the words used to manipulate that data in our minds. We shouldn't look for false comforters, but those presenting the best facts available so we can make informed decisions, whether the data are scary, negative or positive. In times like these we need reality more than ever.

The American economy is extremely fragile, and still years away from any meaningful, sustainable recovery. That must be part of our mindset when we make any investment decision during this season of time.

10 comments:

I have a grinding noise that is keeping me from printing anything from the Cyan toner.

Could this be the same case?

Also visit my web page; xerox phaser 8560 ink sticks

I am mot amazed with your guidance on making tags. I am making use of the Open Office procedure.

Could you encourage, I discover the type is as well

near the side of each label, when I do an examination.

Can I relocate the content to the facility

of the label?

Expect hearing from you and I will

certainly be visting you again.

Here is my blog post :: http://www.veoh.org.uk/

Very helpful info, I have actually always liked laser printers due

to the fact that they are less costly to utilize, once you make the initial investment.

Toner cartrages are more pricey however outlast numerous most

individuals inkjet cartrages and are much less untidy to utilize.

You can set your laser printer to print in grayscale and utilize less of the colour toner, I

only use colour when publishing pictures.

my web blog ... xerox phaser 8560mfp ink

Well thats the initial time ive heared that there

is a reset button on your cartridge, you could save money by

just using this pointer, does this mean i could replenish the cartridge myself and push the

remainder button and my printer will certainly approve that the cartridge is full.

My blog xerox phaser 8560

I have actually created my mailing list of addresses for Christmas much like the video clip shows

making use of MS word 2010 without complications.

I could print one tag per web page or I can easily publish the exact same tag on the page 30

times. I want to publish my listing of different address on the

page so I have 30 various tags to mail. I can easily not get that finished the tag part.

If I publish with the normal going to file, then print, I acquire the file

to print out however not formatted for the type of labels I am utilizing.

I simply do not see how I can do the various

address labels to print in the tag tab.

Thanks,.

Here is my web blog ... xerox phaser 8560dn

thank you a lot !! Complication handle with Samsung ML-1520 on Win8 64bit.

Great!

Lots of introductions from Germany.

Take a look at my page ... xerox phaser 8560 maintenance kit

Yes! It works likewise with a Lexmark E210 with this operation .

.. Thanks very much! I'm very satisfied to continuously utilize my printer!

My homepage :: xerox phaser 8560 ink sticks

Hello! I know this is sort of off-topic but I had to ask. Does building a well-established website

like yours take a massive amount work? I'm brand new to blogging however I do write in my diary on a daily basis. I'd like to start a blog so

I can share my personal experience and views online. Please let

me know if you have any kind of suggestions or tips for

new aspiring blog owners. Thankyou!

Feel free to surf to my blog post ... Sexy Bodybuilder

Download file setup HP LaserJet P1005.

my site - xerox phaser 8560mfp driver (forumscloud.com)

I should downloads printer motorist for Hp Laserjet 1020.

My site; xerox phaser 8560n *http://rpg.camtarn.org*

Post a Comment